Resolve Back Taxes in San Antonio, Texas

accounting

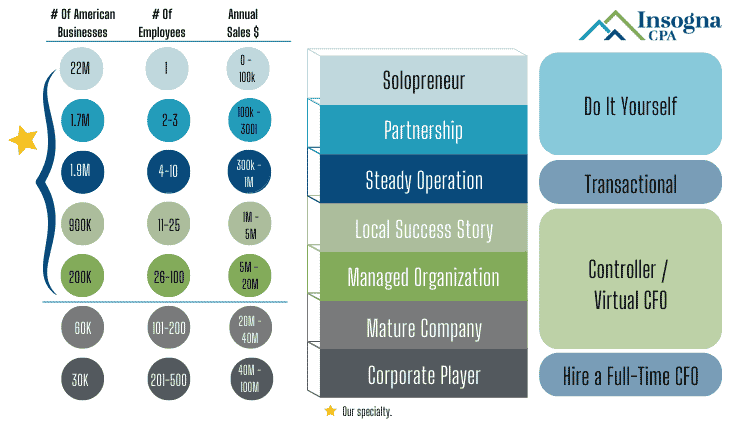

When selecting the right accountant to handle your taxes, always choose someone you have confidence in, connect with, and can establish a long-term relationship with.

Resolve Back Taxes in San Antonio, Texas - tax returrn

- tax returrn

- Transfer pricing

- Charitable deductions

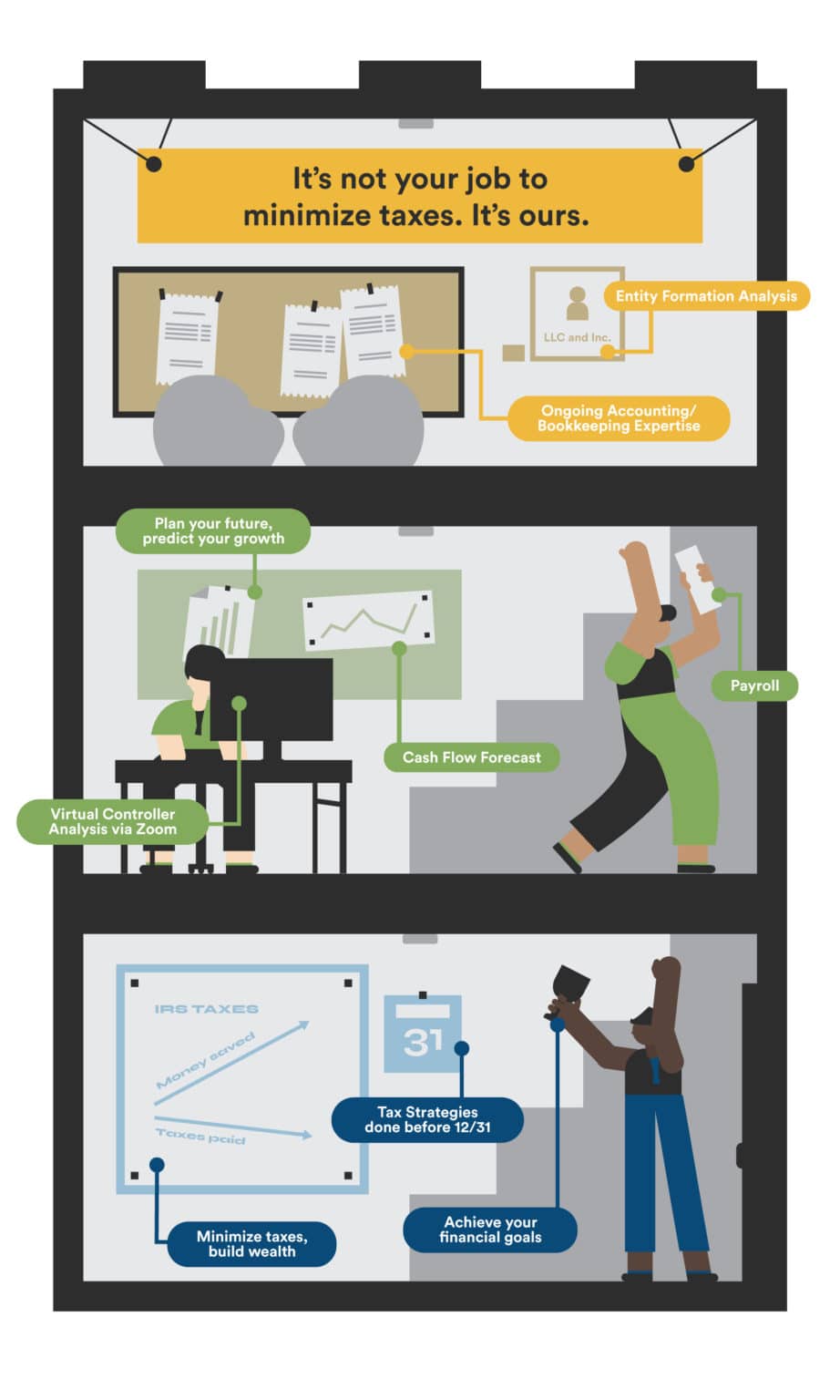

Transparency remains one of our top priorities. At no point in this process do we want you to feel stressed, unsure, or unaware about what is happening. To complement tax preparation services, we offer several individual and business accounting services to meet all your needs. Individual filing taxes, irrespective of income, can utilize IRS Free File to digitally request an automatic tax-filing extension.

While hired to serve their client, they must also diligently remember their obligation to the IRS and avoid any laws or help others in filing a fraudulent return.